Earlier we have discussed about GST and difference between GST and VAT. Let’s know about another important aspect of GST i.e. invoicing. Invoicing has major role when it comes to the execution of a transaction. It is essential document for recording sale/purchase in books of accounts. Invoice contains the details of product like description of product, quantity and rate and amount....Moreover it contains necessary details like the seller name, purchaser name, tax and other particulars like terms and conditions. As per the Rule 11 issued by central government, there are two kinds of invoices. The sample formats of both are discussed here for understanding purpose.

11. Tax Invoice

22. Retail Invoice

1.Tax Invoice

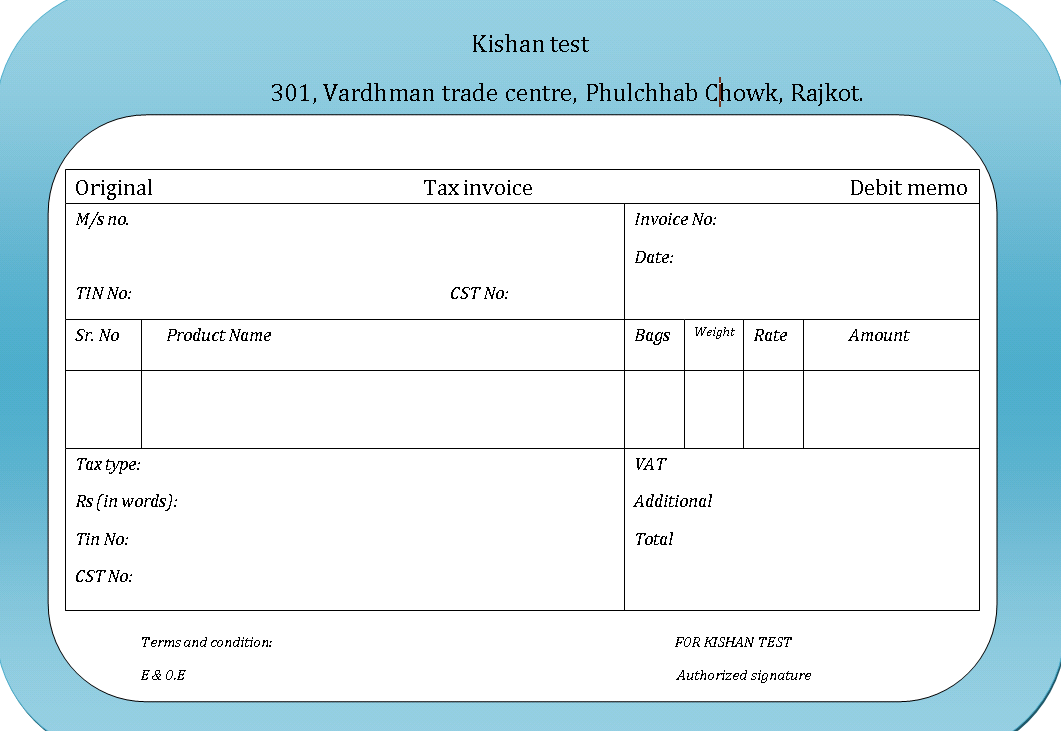

A tax invoice is issued by a registered dealer to the registered purchaser, showing the amount of tax payable. Here is example of tax invoice from Kishan software for APMC merchants.

2. Retail Invoice

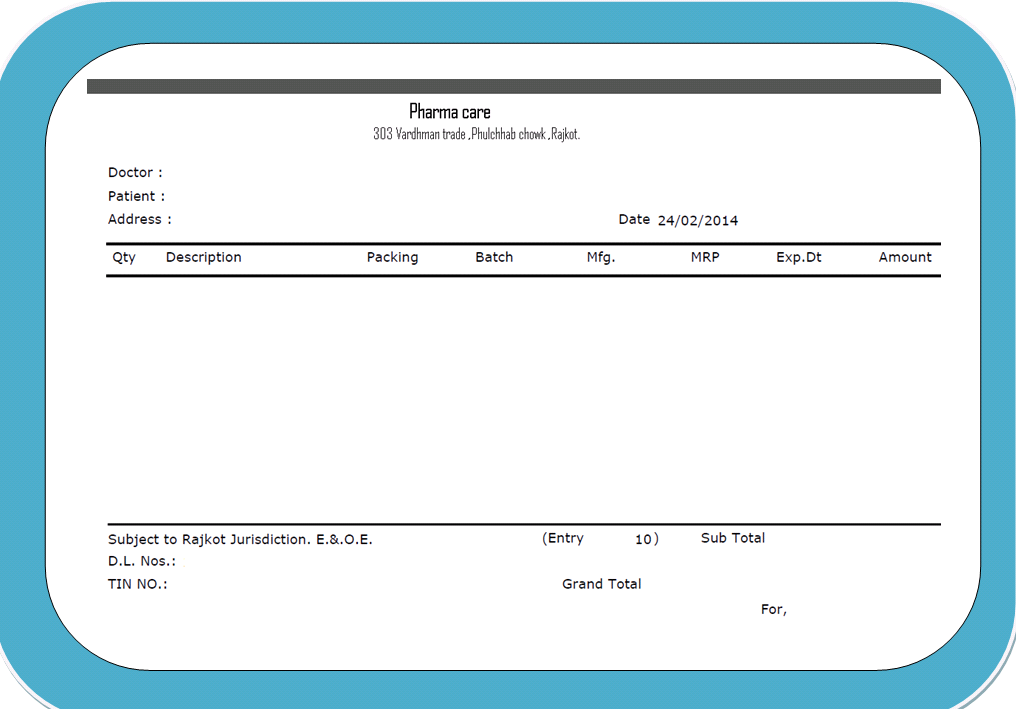

Below is an indicative format is of retail invoice. It is issued to retail customer or dealer who is not registered. In this tax credit can not be claimed.

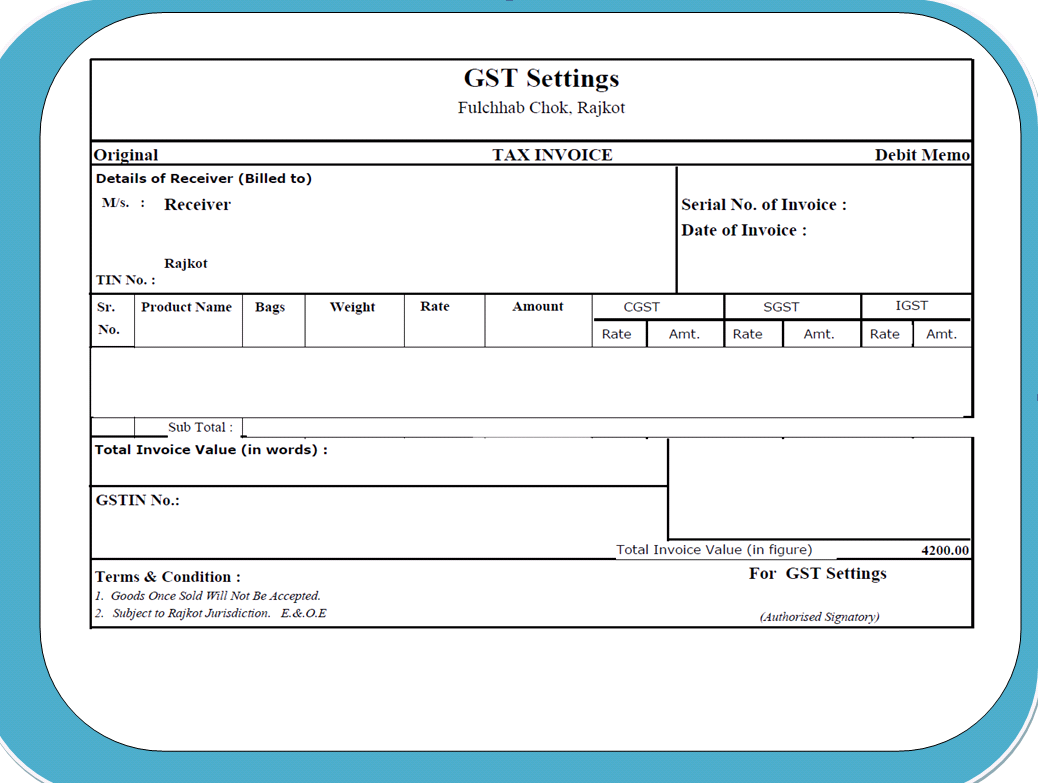

Invoicing under GST regime

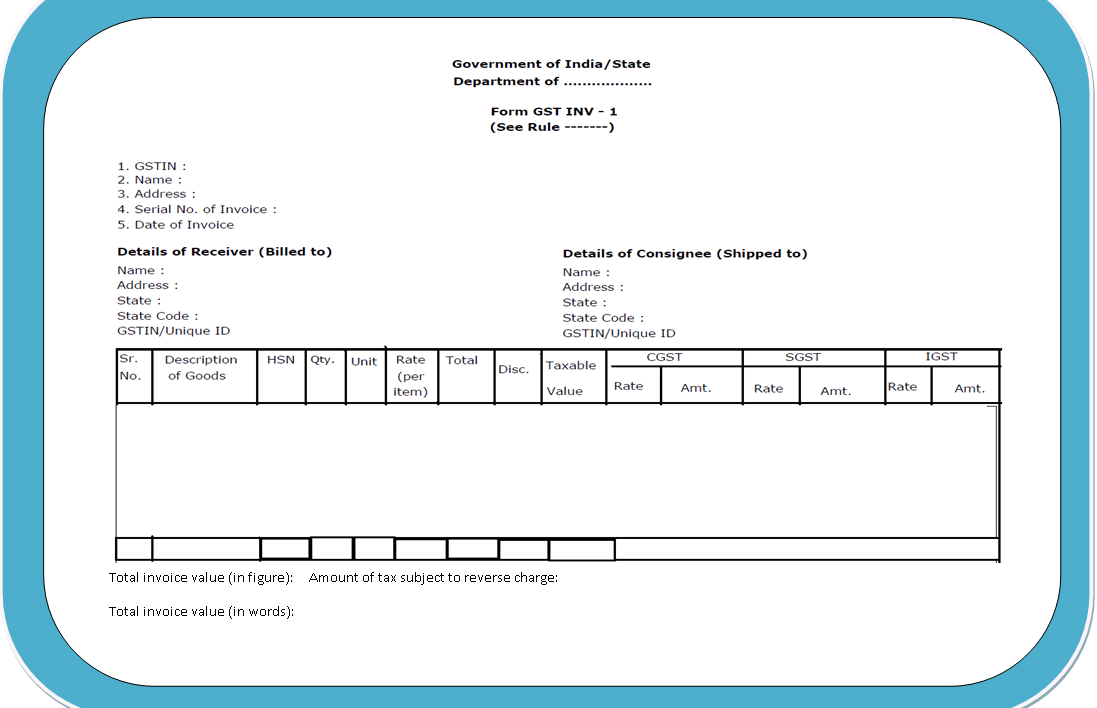

GST contributes for the logistics chain of the business. Manner of the tax invoice differs in each category like it is different for goods supplier than a service provider. Hence, let us understand how invoicing is to be done under GST regime. From 1st July, this indirect tax reform will be applicable. GST helps for doing business as there is no requirement to set up state specific entities and transferring of Stocks. According to invoicing rule (rule no 5) there are two kinds of invoices.

1. Tax invoice

2. Bill of supply

1. Tax Invoice

Tax Invoice under GST is issued from one registered dealer / service provider to another registered dealer / service provider. It is also called B2B invoice. Tax Invoice must have following details.

ü A consecutive serial no.

ü Name, address and GSTIN of the supplier.

ü Date of issue of the document.

ü If recipient is unregistered then name, address, address of recipient and address of delivery with the state name and code.

ü If recipient is registered then name, address and GSTIN /unique ID number of recipient.

ü The date of the original tax invoice or bill supply.

ü Taxable values of goods or services, rate of the tax and amount of the tax credited or debited to the recipient.

Copies of the invoice are essential for supply of goods.

Three Copies of the invoice are essential for supply of goods.

· Original invoice:

ü It is marked as “Original for recipient.”

ü It is issued to the receiver.

· Duplicate copy:

ü It is marked as "Duplicate for Transporter".

ü It is issued to the transporter.

· Triplicate copy:

ü It is marked as “Triplicate for supply.”

ü This copy is retained by the supplier.

Note: If the supplier has obtained an electronic invoice reference number, duplicate copy is not necessary. When supplier uploads a Tax Invoice, the Invoice reference number is given to him in the GST portal. It is valid for 30 days.

Copies of the invoice required for supply of services.

· Original Invoice:

ü It is marked as “Original for recipient”

ü The original copy of the invoice is to be given to receiver.

· Duplicate Copy:

ü It is marked as “Duplicate for supplier”.

ü The duplicate copy is for the supplier.

In case of exports, the invoice shall carry the following endorsement. Supply meant for export on payment of IGST or Supply meant for export under bond without payment of IGST.

It must contain following details:

ü The recipient’s name and address.

ü Address of delivery.

ü Authorized person’s signature.

2. Bill of supply

In GST, there are some instances where the supplier is not permitted to have any tax and hence a tax invoice can’t be issued but another document called Bill of Supply is issued. This invoice is generally issued to charge the tax and pass on the credit. A bill of supply issued by the supplier shall contain the following information and details.

This invoice is generally issued to charge the tax and pass on the credit. A bill of supply issued by the supplier shall contain the following information and details.

ü Name, address and GSTIN of the supplier.

ü A consecutive serial number containing only alphabets and/or numerals, unique for a financial year.

ü Date of its issue.

ü Name, address and GSTIN/ Unique ID Number, if registered, of the recipient.

ü HSN Code of goods or accounting code for services,

ü Description of goods or services.

ü Value of goods or services taking into account discount or abatement, if any.

ü Signature or digital signature of the supplier or his authorized representative.

If the value of the goods or services supplied is less than one hundred rupees, a registered taxable person may not be required to issue bill of supply. Consolidated bill of supply shall be made by the registered taxable person. Consolidated bill of supply shall be prepared by the registered taxable person at the end of each day. In respect of all supplies for value of less than rupees one hundred (Rs. 100).Where bill of supply has not been issued, consolidated bill of supply will only cover supplies.

To revise the taxable value or GST charged in an invoice,

A debit note, supplementary invoice or credit note must be issued.

ü Debit note or supplementary invoice is to be issued by a supplier. It is issued to record increase in taxable value &/or GST charged in the original invoice.

ü Credit note is issued by supplier. The purpose is to record the decrease in taxable value &/or GST charged in the original invoice. It must be issued on or before 30th September following the end of the financial year in which the supply was made or the date of filling of the relevant annual return, whichever is earlier.

v For example,

Star furniture Ltd sells furniture worth Rs. 12, 00,000 to Rainbow hotels Ltd. on 1st November ‘17. On 2nd November’17, Rainbow hotels returned furniture of Rs 2, 00,000, being damaged goods. Star furniture wants to raise a credit note for the goods returned. Let us discuss when star furniture Ltd. must issues the credit note using following situations.

|

Situation |

Date of original supply |

Annual return filling date |

Condition for determining the last date to issue credit note |

Last date for issuing credit note |

|

1 |

1st November 2017 |

1st December 2018 |

30th September following the end of the financial year in which the supply was made or date of filling annum return, whichever is earlier. |

30th September 2018 |

|

2 |

1st November 2017 |

31st May 2018 |

Same as above |

31st May 2018 |

![]()